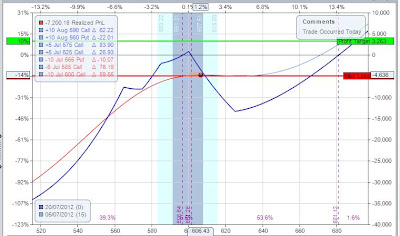

I took my profit on the SPX. See the pic. I'd been in the trade long enough and I took a 6% profit and re-invested my margin in another trade. By the close the trade would have been down. My profit taking was more good luck than good management, or maybe I saw something that I didn't know I was seeing. Anyway, if a trade is making a reasonable profit and looks like stalling then it's better to grab the profit than give it back.

EL TRADES OPTIONS

This blog will show my longer term Swing trades using OPTIONS. I use specific income producing option strategies with a DIRECTIONAL BIAS. Having a directional bias is critical in earning more, even from what are generally called income trades such as butterflies and condors. The aim of my strategies is to give me more than a 66% edge and to provide a greater than 80% win rate within that edge. The blog shows you the trades I make and how I manage them. For my directional bias, I use the same EL methodology as I employ in my day trading that you have seen for years in the original ElectronicLocal blog. Read the disclaimer.

Monday, July 30, 2012

Thursday, July 26, 2012

Updates AAPL and SPX

I scratched my AAPL trade (broke even except for commish). My idea of a better reception for the quarterly news was wrong. What was good that even when I wasn't right, I didn't lose on the trade. Options are a great vehicle.

The SPX trade is still open. As you can see from the risk graph below, I'm almost at my 10% profit, but not quite. I've been in the trade since July 17 and would like to get out now, so I might accept 8% rather than 10%. I'll see how the day progresses.

I'm planning on putting on a major RUT butterfly today or tomorrow. Major due to its size and type. I'm going to scale into the position if the market co-operates. More details when the first leg is on.

Meanwhile, I'm heading to the beach this morning as it's going to be a scorcher here in France. More vistors arriving here tomorrow. I'm only day trading when I have time and letting Flo, my algo, do the daytrading most of the summer and these option trades only need looking at once a day. Freedom!

The SPX trade is still open. As you can see from the risk graph below, I'm almost at my 10% profit, but not quite. I've been in the trade since July 17 and would like to get out now, so I might accept 8% rather than 10%. I'll see how the day progresses.

I'm planning on putting on a major RUT butterfly today or tomorrow. Major due to its size and type. I'm going to scale into the position if the market co-operates. More details when the first leg is on.

Meanwhile, I'm heading to the beach this morning as it's going to be a scorcher here in France. More vistors arriving here tomorrow. I'm only day trading when I have time and letting Flo, my algo, do the daytrading most of the summer and these option trades only need looking at once a day. Freedom!

Wednesday, July 25, 2012

AAPL Losing Trade, So Far, SPX In Profit

So far, the AAPL trade from yesterday looks like a losing trade. The numbers last night caused a late sell off in AAPL. I'll manage the trade and try to get out at break even or a loss if the market doesn't allow that.

My SPX trade has almost hit a 10% profit and I will be looking to take it off at 10%.

I'll post the results.

My SPX trade has almost hit a 10% profit and I will be looking to take it off at 10%.

I'll post the results.

Tuesday, July 24, 2012

Apple Earnings Spec Trade

I bought a Broken Butterfly on July AAPL. I BOT +590 PUT, --585PUT, +575PUT. I'm banking on either a good reaction to the earnings report tonight or one that doesn't take out my short 585 PUTs. I've traded July as they expire on Friday.

This is a pure speculative trade and I'm risking a maximum of just a bit under $10,000 and I can make 28% on the trade. The maths of this trade only work with the high win rate I have with them.

This is a pure speculative trade and I'm risking a maximum of just a bit under $10,000 and I can make 28% on the trade. The maths of this trade only work with the high win rate I have with them.

Wednesday, July 18, 2012

Made to Measure

I believe that by having a directional bias I am able to better pick a strategy to use. I have three variations of butterflies and condors that I can choose from. If I want to be very directional then there is the Vertical Spread, but this has more risk and a lower win rate if the directional bias is wrong. With my butterflies and condors I am profitable in most cases, even if my directional bias is wrong.

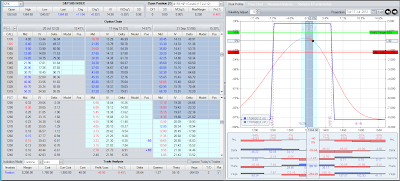

It took me two days to get filled on this Iron Condor. +1425V/-1415C/-1255P/-1245P. I'm showing it as a 10 lot trade with margin of less than $10,000. I received a credit of £1.80 or $1,800 to make this trade. My goal is to keep as much of this money as I can between now and when I take it off before expiry which is in 32 Calendar days.

As you can see in the software, the position has over a 78% chance of making money, even if I don't adjust it. I'll use some of the $1,800 to make adjustments to the trade if I need to. The high of the ES hit a daily FavFib area and I expect a pullback within a day or two. This is one of four criteria I have in order to make this trade. I'll take the position off if I make 10% on my margin or about $900 per 10 contracts. I have a specific trading plan to manage the position until then, as the market unfolds.

It took me two days to get filled on this Iron Condor. +1425V/-1415C/-1255P/-1245P. I'm showing it as a 10 lot trade with margin of less than $10,000. I received a credit of £1.80 or $1,800 to make this trade. My goal is to keep as much of this money as I can between now and when I take it off before expiry which is in 32 Calendar days.

As you can see in the software, the position has over a 78% chance of making money, even if I don't adjust it. I'll use some of the $1,800 to make adjustments to the trade if I need to. The high of the ES hit a daily FavFib area and I expect a pullback within a day or two. This is one of four criteria I have in order to make this trade. I'll take the position off if I make 10% on my margin or about $900 per 10 contracts. I have a specific trading plan to manage the position until then, as the market unfolds.

Monday, July 16, 2012

Monitoring Option Positions - Away from Home

I've finally found the tool that gives me freedom - I get alerts when I need them and can put on a hedge if required. It's the Samsung Galaxy Note II due out in September, according to this blog. All I need to find is a case that I can hang on my belt. My iPad is getting too cumbersome to carry. I'm day trading less. Flo and options carry most of the load these days. A couple of hours discretionary trading is what happens most days.

Samsung Galaxy Note II looks pretty big and runs IceCreamSandwich or Jelly Bean. I will be able to connect to all my brokers and my charts/FloBot through the Cloud and actually see what I'm looking at. It's going to be more convenient to carry than my iPad.

What do I alert and what can I do about them from a small device? Lots of choices.

Firstly, I alert myself for the UNDERLYING - the stock or index - hitting a price above AND below the previous close. The prices I pick are prices where I would need to do something.

OK, I get an alert - an email or SMS (I can choose). When this happens, I don't have to figure out what to do because I have already worked it out - before I left home.

Usually, I will want to go to delta neutral first. This will give me time to make any adjustments I need to make. I can go delta neutral quite easily using an underlying and I can do this with a couple of clicks even on a small device like a smartphone or Pad. For example, I may have a RUT butterfly on and I would need to do something if price goes above 858.00 or below 723.00. I know what my delta position on the butterfly would be at each of those prices because I looked it up on my risk graph or brokers greek table. I also know that I will use, say, 1 Russell future for every delta point I need to hedge.

I can execute this a couple of different ways:

- I can leave a sell stop and a buy stop with my broker to make the trade when either of these prices are hit, or,

- I can execute them myself when an email/SMS alert is received.

I have an account with TDAmeritrade and get the ThinkOrSwim software for free. This software allows trading, monitoring and backtesting although it does not carry a cumulative total of profitability after adjustments, but you can keep track of this manually. The added bonus here is the smartphone app with alerts.

This whole operation is a very rare occurrence and is designed only for black swan events. It's mainly to give me peace of mind. I usually only look and adjust my option positions once a day and usually at the same time of day and at a time when I'm usually at my workstation or my laptop in a hotel. I can travel and have a life away from my workstation and keep on earning. No daytrading but certainly option trading and managing Flo's autotrading.

Friday, July 13, 2012

Out of the RUT

I exited the RUT trade yesterday. It was not an easy trade and I had locked it into a stable position as I reported in a previous post. I had a great opportunity yesterday to get out at a small profit and be ready to reuse the margin I had tied up in the trade.

The market traded down to that support area and held, so I sold out my long August PUTs in the RUT and started covering my short PUTs after the market took out the high of the day. I covered all the way to the bottom of the previous day's Value Area where I became flat and the trade was closed. I could have waited till closer to expiration to close the trade as the position had no risk to the upside and I did expect the rally but I had considerable margin tied up in a position with only very limited profit possibility - see the risk graph of the previous RUT post so 2% was good in the circumstances and allows me to re-invest the margin.

Monday, July 9, 2012

Monday Update

Just discovered some comments that I wasn't notified were there awaiting moderation. I'll catch up answering these tomorrow.

We're getting a lot of volatility in the stock markets. Around 10% down and then 10% up. Markets were awesome until about June 26 and have been a bit more difficult since. However, I closed the month of June well ahead of my plan. July is starting slowly but there are 22 days left in this month and I expect to hit my plan of at least 10% return.

My AAPL trade closed on Friday for a 4% loss. The trade just didn't work. Same, -4%, with the TLT. I've changed my directional view on the TLT, so closed the position.

My RUT position will be decided this week. I'm expecting a pullback and then a rally. If the rally comes early then no adjustment, otherwise I'll need a tweak.

I had an EEM trade on that I took off today at +7%. It was a butterfly with a short bias that partly balanced the RUT long bias. As I'm looking for the RUT to rally from here I decided that the EEM could rally with the RUT so I should take profits.

We're getting a lot of volatility in the stock markets. Around 10% down and then 10% up. Markets were awesome until about June 26 and have been a bit more difficult since. However, I closed the month of June well ahead of my plan. July is starting slowly but there are 22 days left in this month and I expect to hit my plan of at least 10% return.

My AAPL trade closed on Friday for a 4% loss. The trade just didn't work. Same, -4%, with the TLT. I've changed my directional view on the TLT, so closed the position.

My RUT position will be decided this week. I'm expecting a pullback and then a rally. If the rally comes early then no adjustment, otherwise I'll need a tweak.

I had an EEM trade on that I took off today at +7%. It was a butterfly with a short bias that partly balanced the RUT long bias. As I'm looking for the RUT to rally from here I decided that the EEM could rally with the RUT so I should take profits.

Friday, July 6, 2012

New Position and More Adjustments

I put on a new position and made some more adjustments after my post of yesterday.

AAPL now looks like this:

My cumulative P&L is down about 6% on Max margin. I'll try and get out at break even on this trade as it hasn't worked. I'm prepared to take a loss too if it doesn't look like this will happen.

The new trade is on TLT.

This is a Broken Butterfly and is part of a bigger position that I want to put on. Downside is a locked in Profit and my present break even on the upside is 131.49.

AAPL now looks like this:

My cumulative P&L is down about 6% on Max margin. I'll try and get out at break even on this trade as it hasn't worked. I'm prepared to take a loss too if it doesn't look like this will happen.

The new trade is on TLT.

Thursday, July 5, 2012

AAPL and RUT

Stablizing my AAPL position. I'll see what I do next after a day or two. I added a butterfly and bought some calls back. I'm going to exit this position at break even when I can. It will probably need some more adjustments. If I can see a short term top, I'll sell the August CALLs I am long and then cover the August PUTs after it has pulled back. Anyway, that's the current plan, subject to change.

Looks to me that the RUT may rally so I've converted the position into a broken Butterfly. This will lock me into a sure profit of at least 4% unless price goes below about 755.

Looks to me that the RUT may rally so I've converted the position into a broken Butterfly. This will lock me into a sure profit of at least 4% unless price goes below about 755.

Monday, July 2, 2012

Batman

I put on the RUT position below on Thursday and Friday. There are three trades in the position so far. They are Butterflies and the idea is to capture a wide tent and earn 10%. The position is a little down as RUT rallied on Friday. On Friday, I added another 10 sets to Thursday's original butterfly - 710/760/810 AUG PUTs and later in the day on Friday I added the 870/820/770 AUG PUT butterfly.

This gives me a tent of 738 to 841 wide for break even and a decent maximum profit in the tent that will allow adjustments if needed. I hope to add to this position so that the Reg-T margin is about $200K. A 10% profit will then earn me $20,000 and I hope to do this in the next 30 days or less.

A down move will push me towards profit and an upmove will allow me to add to the position. We'll see how it goes.

The AAPL position is still on with price moving back into the middle of the tent. I'm not making any money on that trade yet as volatility and price moved against me. Let's see what happens this week as theta (price erosion) kicks in.

This gives me a tent of 738 to 841 wide for break even and a decent maximum profit in the tent that will allow adjustments if needed. I hope to add to this position so that the Reg-T margin is about $200K. A 10% profit will then earn me $20,000 and I hope to do this in the next 30 days or less.

A down move will push me towards profit and an upmove will allow me to add to the position. We'll see how it goes.

The AAPL position is still on with price moving back into the middle of the tent. I'm not making any money on that trade yet as volatility and price moved against me. Let's see what happens this week as theta (price erosion) kicks in.

Subscribe to:

Posts (Atom)