I believe that by having a directional bias I am able to better pick a strategy to use. I have three variations of butterflies and condors that I can choose from. If I want to be very directional then there is the Vertical Spread, but this has more risk and a lower win rate if the directional bias is wrong. With my butterflies and condors I am profitable in most cases, even if my directional bias is wrong.

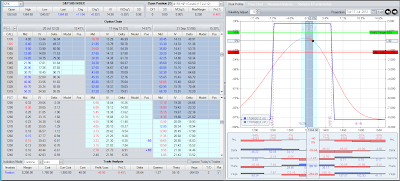

It took me two days to get filled on this Iron Condor. +1425V/-1415C/-1255P/-1245P. I'm showing it as a 10 lot trade with margin of less than $10,000. I received a credit of £1.80 or $1,800 to make this trade. My goal is to keep as much of this money as I can between now and when I take it off before expiry which is in 32 Calendar days.

As you can see in the software, the position has over a 78% chance of making money, even if I don't adjust it. I'll use some of the $1,800 to make adjustments to the trade if I need to. The high of the ES hit a daily FavFib area and I expect a pullback within a day or two. This is one of four criteria I have in order to make this trade. I'll take the position off if I make 10% on my margin or about $900 per 10 contracts. I have a specific trading plan to manage the position until then, as the market unfolds.

EL TRADES OPTIONS

This blog will show my longer term Swing trades using OPTIONS. I use specific income producing option strategies with a DIRECTIONAL BIAS. Having a directional bias is critical in earning more, even from what are generally called income trades such as butterflies and condors. The aim of my strategies is to give me more than a 66% edge and to provide a greater than 80% win rate within that edge. The blog shows you the trades I make and how I manage them. For my directional bias, I use the same EL methodology as I employ in my day trading that you have seen for years in the original ElectronicLocal blog. Read the disclaimer.

No comments:

Post a Comment