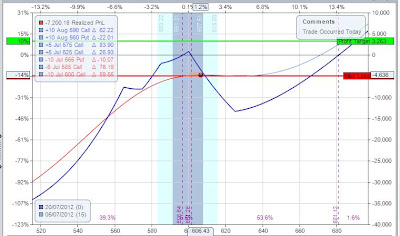

Stablizing my AAPL position. I'll see what I do next after a day or two. I added a butterfly and bought some calls back. I'm going to exit this position at break even when I can. It will probably need some more adjustments. If I can see a short term top, I'll sell the August CALLs I am long and then cover the August PUTs after it has pulled back. Anyway, that's the current plan, subject to change.

Looks to me that the RUT may rally so I've converted the position into a broken Butterfly. This will lock me into a sure profit of at least 4% unless price goes below about 755.

EL TRADES OPTIONS

This blog will show my longer term Swing trades using OPTIONS. I use specific income producing option strategies with a DIRECTIONAL BIAS. Having a directional bias is critical in earning more, even from what are generally called income trades such as butterflies and condors. The aim of my strategies is to give me more than a 66% edge and to provide a greater than 80% win rate within that edge. The blog shows you the trades I make and how I manage them. For my directional bias, I use the same EL methodology as I employ in my day trading that you have seen for years in the original ElectronicLocal blog. Read the disclaimer.

No comments:

Post a Comment